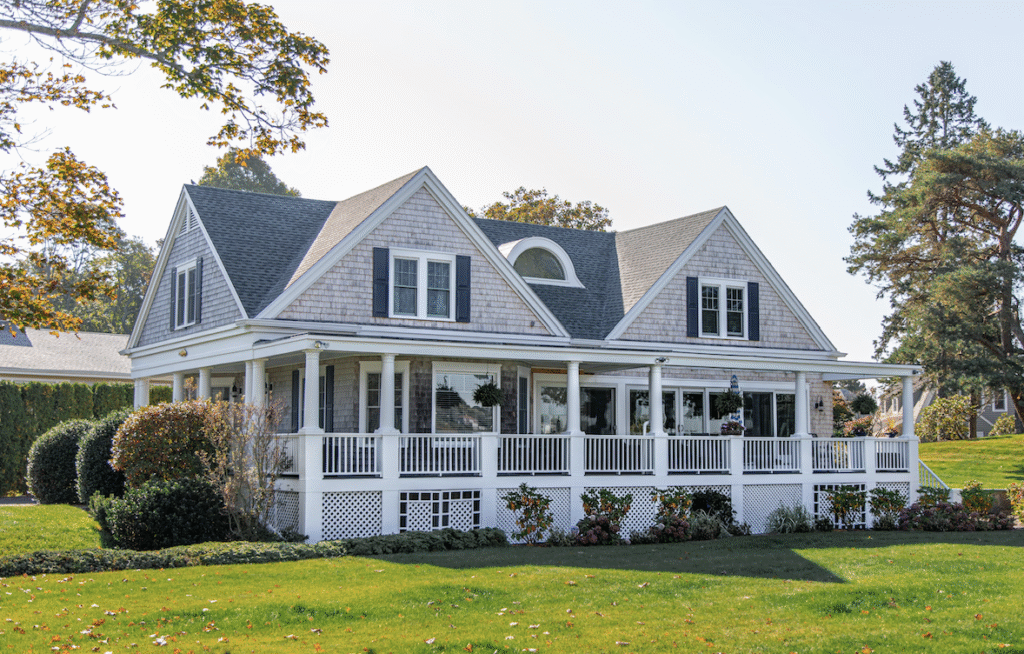

You try to pay all your bills on time, but sometimes life gets in the way. While lenders or the IRS may understand occasional delays, they’re still expecting payment. If debts go unpaid, you could face not just collection calls, but a lien on your property. But what exactly is a lien, and how can you prevent one?

What Is a Lien and How Does It Happen?

Opening your mailbox to see a lien notice is never fun. Todd Christensen, housing counseling and education manager and author of Reverse Mortgage Myths Busted, explains: “A lien is a legal claim or hold on a property—such as a home or vehicle—that secures payment of a debt or obligation. When a borrower fails to pay a loan, taxes, or a contractor, a lien allows creditors to use the property as collateral until the debt is resolved.”

Before a lien is granted, there’s a process. Mary Beth Lanigan, Residential Underwriter for Proper Title, LLC, notes: “Depending on who is owed money, they may go to court to get a judgment against you. If you owe taxes to the IRS or State, they don’t need to go to court. They can record a lien if assessed taxes remain unpaid after a demand for payment.”

Can You Prevent a Lien?

Liens don’t appear overnight, and many are preventable. “Liens can only be avoided by being vigilant,” says Christopher Migliaccio, attorney and founder of Warren and Migliaccio L.L.P. “Pay taxes and debts on time, insist on lien waivers for renovations, and track every subcontractor payment. These small steps can save years of litigation.”

Not all liens are enforceable. “I’ve successfully vacated liens where proper notice wasn’t provided or filings were outside the statute of limitations,” Migliaccio adds. “Even after a lien is vacated, public records may still raise questions with lenders, so address it quickly with competent representation.”

Jose Rodriguez, U.S. Marine veteran and founder of Got Credit?, emphasizes proactive financial management: “Respond to lawsuits—ignoring a summons is how judgment liens happen. For renovations, use written contracts, pay in milestones, and collect lien waivers. You can also set up formal payment plans with the IRS or county before a lien is recorded. Agencies often prefer cooperation over enforcement.”

Who Can Place a Lien?

Rodriguez explains: “Common lienholders include mortgage lenders (voluntary), the IRS and state revenue departments (tax liens), counties/municipalities (property taxes, code enforcement, unpaid utilities), HOAs/condo associations (assessment liens), licensed contractors and suppliers (mechanics’ liens), and judgment creditors (after a court award). Small businesses may also see UCC liens on equipment or receivables. For families, the big ones are taxes, judgments, contractors, and HOAs.”

Migliaccio adds: “Homeowners are often surprised by how easily liens can arise, sometimes from a subcontractor they’ve never met.”

How Do Liens Affect Your Credit and Finances?

Liens don’t directly affect your FICO score. Since 2018, major consumer reporting agencies have stopped reporting most judgments and tax liens; only bankruptcies are still included. Christensen explains: “Liens can hurt credit if they lead to foreclosure or other reportable accounts, but generally, they are more of a transaction risk than a scoring event.”

Even if they don’t appear on credit reports, liens can impact your ability to sell or refinance property. Unpaid liens accrue penalties and interest, risking foreclosure or forced sale, which can increase borrowing costs and complicate future credit applications. Rodriguez notes: “Lenders and title companies search public records; an open lien can block a refinance or home sale, force higher rates, or require extra reserves. Collections tied to liens can also appear on your credit report.”

How to Resolve a Lien

The simplest way to remove a lien is to pay it off or reach a settlement. Rodriguez advises: “Get a payoff letter, pay the lienholder, and ensure a Release/Satisfaction of Lien is recorded with the county.”

If you’re selling or refinancing, the title company may pay the lien from proceeds and record the release. You can also challenge invalid liens if deadlines, amounts, or notices were improper. For very old or inactive liens, a quiet title action may be appropriate. Lanigan adds: “Once there is a valid lien, obtain a payoff letter or set up a payment plan. Many liens have a statute of limitations for enforcement.”

Receiving notice of a lien can be intimidating, but it can also serve as a wake-up call to protect your assets. Rodriguez reminds homeowners: “A lien isn’t the end of the road—it’s a signal to act.”